Skip to main content

Create an Invoice

Generate and send invoices to clients or vendors — with full control over items, taxes, payment terms, and audit visibility.

🔐 Access Control

- Only Admin users or staff with invoice permissions can create invoices

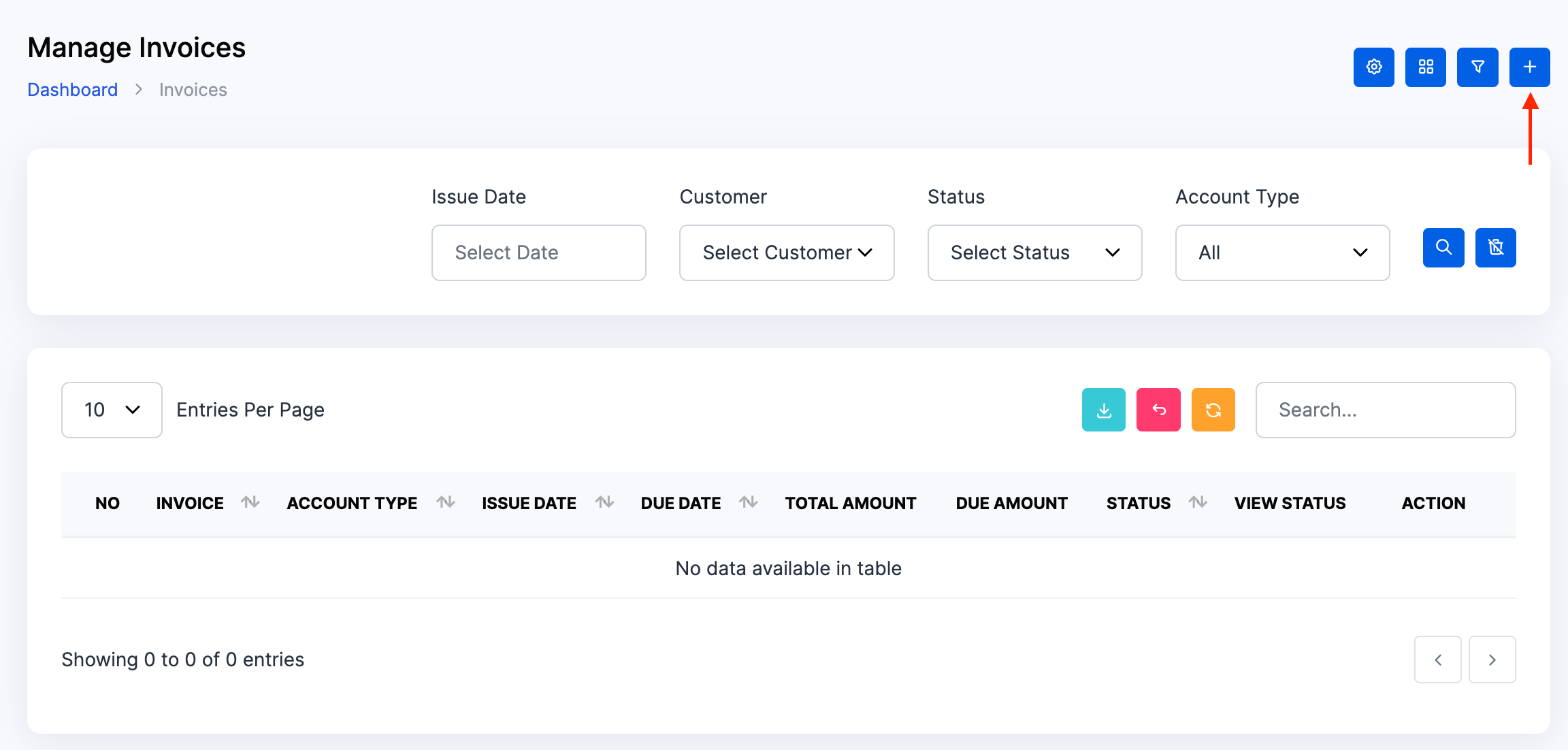

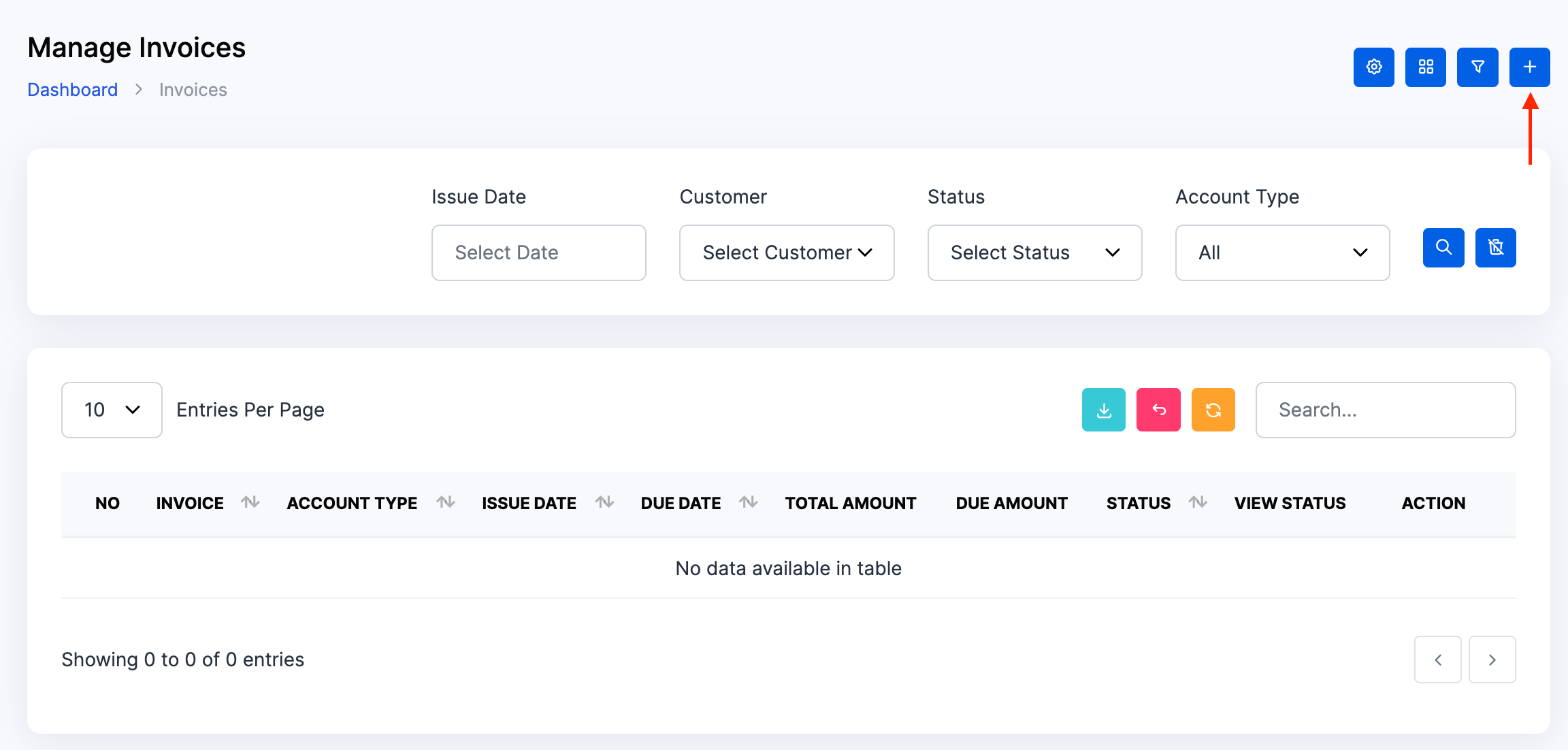

- From the Dashboard, go to Invoice → Plus Icon

🧭 Step-by-Step Invoice Creation

1️⃣ Account Type (Required)

- Choose between Accounting or Projects

- This selection defines how the invoice is tracked and reported

- ⚠️ You cannot change the account type after creation

2️⃣ Billing Type (Auto-selected)

- If Accounting is selected → Billing Type will be Item Wise

- If Projects is selected → Billing Type will be Project Wise

- This field is auto-set and cannot be manually changed

3️⃣ Customer / Client

- Select the recipient from your CRM list

- If not listed, click Create Customer/Client to add them first

4️⃣ Template

- Choose a visual layout for the invoice

- Templates affect branding, logo placement, and field visibility

5️⃣ Dates

- Issue Date: Defaults to today, but can be backdated

- Due Date: Set based on payment terms (e.g. Net 7, Net 30)

6️⃣ Category

- Select a revenue category (e.g.

Consulting,Cleaning,Logistics) - Categories must be pre-created in Accounting Setup

7️⃣ Invoice Number

- Auto-generated (e.g.

#INV00001) - Can be manually edited if permitted by settings

🧩 Adding Items

Click + Add Item to open the item entry form.

For each line item:

- Item Type: Choose

Product,Service, orPart - Item: Select from your item list (must be pre-created)

- Quantity: Enter the number of units

- Unit: Auto-filled from item setup

- Price: Auto-filled or manually adjusted

- Discount: Optional per line

- Tax (%): Select applicable tax rate

- Description: Optional notes for clarity

The system will auto-calculate:

- Subtotal

- Total Discount

- Total Tax

- Total Amount

📤 Final Steps

- Click Create to generate the invoice

- The invoice will be saved in Draft status

- You can edit, review, or send the invoice from the draft view

- Once finalised, use the Send button to email the invoice or share via client portal

- Optionally enable payment integrations (e.g. Stripe, PayPal) for instant settlement

✅ Best Practices

- Ensure all items, categories, and taxes are pre-configured

- Use consistent invoice numbering for audit clarity

- Include payment terms and late fee logic in the template or notes

- Review overdue invoices weekly

- Use sector-fit item descriptions (e.g.

Cleaning Visit,Freight Charge,Care Package) - Link invoices to CRM or Project records for traceability

- Always review draft invoices before sending — especially for tax, due date, and item accuracy